Maximize Duty Drawback Refunds. On Autopilot.

With decades of licensed customs experience, we help SMBs recover millions in overpaid duties — combining expert oversight with automation to handle the entire process, end to end.

How it works.

What it looks like to recover import duties with our fully-managed drawback service — powered by partnerships with licensed customs brokers — from first consultation to refund.

Free consultation

We start with a complimentary assessment of your historical import activity — no integrations required. We guide you through exactly what documentation is needed and where to find it.

We identify and file eligible claims

Our experts partner closely with trusted customs brokers to review your data and prepare drawback claims. From reconciliation and classification to submission, our integrated team manages the process seamlessly.

You get future claims on autopilot

Once approved by U.S. Customs, funds are deposited directly into your account. As we file your initial claims, we also set you up in our secure online portal — where your future claims are filed on autopilot.

Modern approach to duty drawback.

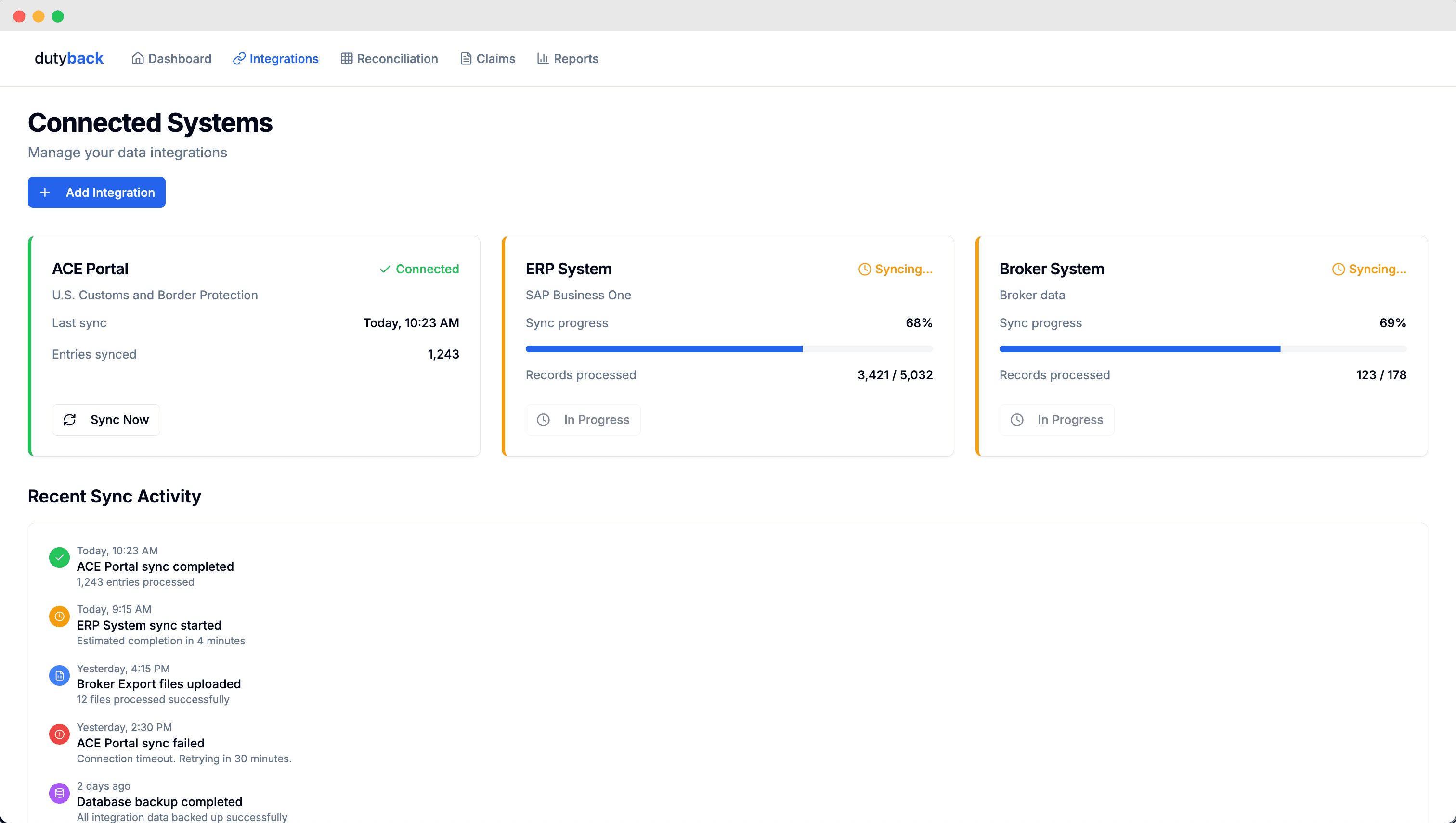

Our platform seamlessly integrates with your systems to automatically reconcile shipments, identify eligible refunds, and file on your behalf. All under the supervision of experienced licensed customs brokers.

Simply drop your files into our platform or connect directly to your ERP, ACE, and broker systems.

Why us.

Our team includes licensed brokers who’ve recovered millions in duty fees, and engineers who’ve built best-in-class software products.

Licensed Brokers

Built on decades of CBP experience and thousands of successful claims.

We work alongside licensed customs brokers who've filed thousands of successful drawback claims — and helped clients navigate audits, reclassifications, and regulatory shifts.

Engineered for Automation

Powered by clean, modern infrastructure.

Our team includes engineers who've built secure, scalable systems at leading technology companies. We've replaced the manual, PDF-driven workflows with automation and audit-grade reliability.

No Surprises

Transparent, trackable, and audit-ready.

You'll always know what's been filed, what's pending, and what's been refunded — with a clear paper trail at every step. Our platform makes drawback feel as simple as checking your balance.

Built on decades of CBP experience and thousands of successful claims.

We work alongside licensed customs brokers who've filed thousands of successful drawback claims — and helped clients navigate audits, reclassifications, and regulatory shifts.

Powered by clean, modern infrastructure.

Our team includes engineers who've built secure, scalable systems at leading technology companies. We've replaced the manual, PDF-driven workflows with automation and audit-grade reliability.

Transparent, trackable, and audit-ready.

You'll always know what's been filed, what's pending, and what's been refunded — with a clear paper trail at every step. Our platform makes drawback feel as simple as checking your balance.

Frequently asked questions.

Ready to recover your overpaid duties?

We will review your import/export activity, estimate your potential refund, and guide you through your first claim — start to finish.

Book a free consultation